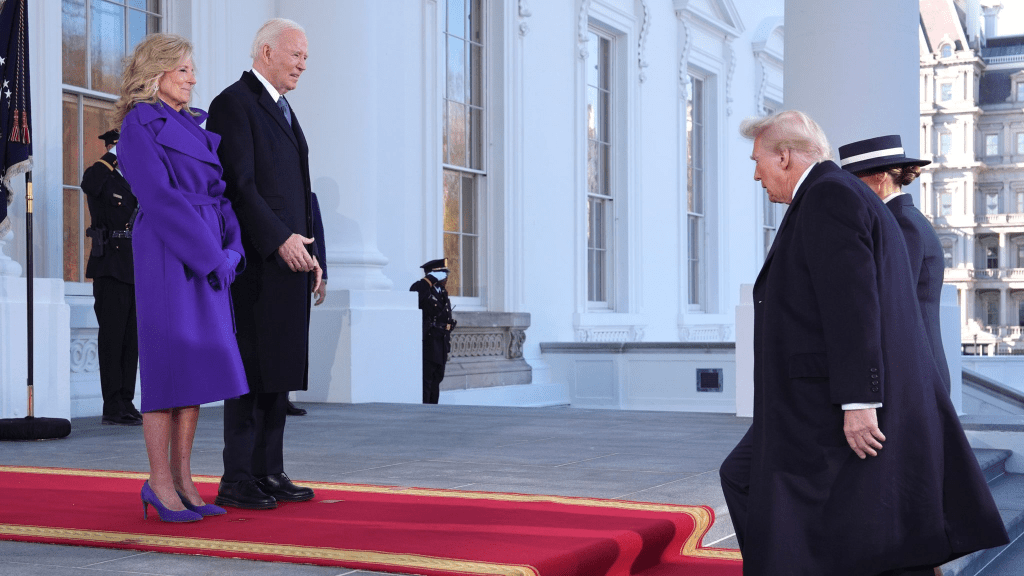

Donald Trump’s second inauguration as America’s 47th president today (20 January) is expected to have significant consequences, not just for the US, but for people living in the UK as well. Following his first term in office, Trump is promising “a brand new day of American strength and prosperity, dignity and pride,” but for the UK, this shift could bring about some notable changes.

Potential for Higher Taxes or Reduced Public Spending in the UK

After Trump’s election win, financial markets have experienced increased volatility, which could have an impact across the Atlantic. Lindsay James, investment strategist at Quilter Investors, explained that concerns about rising inflation and interest rates in the US might lead to higher government borrowing costs in the UK. This could force the UK government to either increase taxes or reduce spending, potentially affecting public services.

Ashley Webb, an economist at Capital Economics, noted that Trump’s second term could result in faster US inflation and higher interest rates, which could spill over into the UK market, pushing up borrowing costs. This could lead to a situation where the UK government faces pressure to either raise taxes or decrease public spending.

Higher Inflation in the UK

Trump’s policies, particularly his approach to tariffs on Chinese and other global imports, could cause inflation to rise not just in the US, but around the world. If US inflation increases, other nations might also impose tariffs on American goods, further pushing up global inflation rates, including in the UK.

Lindsay James highlighted that inflation expectations have already heightened, with the Bank of England adjusting its inflation forecasts upward for the next three years, suggesting that rate cuts could be delayed.

Higher Interest Rates and Mortgage Costs

For UK households, the most immediate impact could be felt through higher interest rates. Stephen Millard, from the National Institute of Economic and Social Research, pointed out that the US Federal Deficit is likely to increase under Trump’s policies, leading to a strengthening of the US dollar against the pound. This could result in higher inflation in the UK, translating into higher mortgage rates and household bills for British consumers.

Rising Shop Prices

If the US dollar strengthens, British consumers could face higher costs when shopping for imported goods. While the UK’s trade with the US is largely service-based, making it less likely that consumer goods prices will dramatically rise, there could still be an indirect effect on prices due to stronger tariffs.

Impact on British Businesses

As the largest market for UK exports in 2023, the US plays a crucial role in British business. If Trump’s tariffs on imports increase, it could make trading with the US more expensive, raising the cost of UK products in the American market. This could lead to reduced demand and lower profit margins for British businesses that rely on exports to the US. Chancellor Rachel Reeves has already stated that the UK will make “strong representations” to maintain a free trade relationship with the US.

More Expensive Holidays to America

For UK travelers planning holidays to the US, the weakened pound could make their trips more expensive. Dan Coatsworth, an investment analyst at AJ Bell, explained that the pound has fallen 5.9 percent against the US dollar since the election. As a result, travelers will get less value for their money. For example, someone exchanging £3,000 for US dollars now would receive $230 less than they would have on Election Day.

Effects on Pensions

For many UK citizens, their workplace pensions are tied up in US stocks and shares, with around 40 percent of pension funds invested in the US market. This means that if the US stock market remains volatile under Trump’s policies, pension values could be affected. However, the situation isn’t entirely bleak. According to Justin Onuekwusi, CIO at St. James’s Place, sectors tied to international trade, such as tech and consumer goods, could experience volatility, while Trump’s deregulation and tax cuts could provide short-term boosts to industries like energy, financials, and defense.

Savings Rates

Higher interest rates, a likely result of Trump’s economic policies, could benefit savers by offering better returns on savings accounts. However, if inflation is also high, the value of savings could be diminished, making it important for UK residents to manage their finances carefully in the coming years.

As Donald Trump embarks on his second term, the policies and decisions made during his presidency are set to have ripple effects across the globe. For those in the UK, these changes could mean everything from higher taxes to more expensive holidays and increased costs of living. The full extent of the impact remains to be seen, but the UK will certainly feel the effects of Trump’s leadership over the next four years.